Integrated Full Package Home Design with End to End Construction Management

Expert Construction Management: Building a Strong Foundation

Construction management forms the backbone of any successful building endeavor. It spans a diverse array of duties, starting from preliminary planning and financial forecasting through to the ultimate inspection and project delivery. Seasoned construction professionals bring extensive knowledge of the complete workflow, guaranteeing projects adhere to timelines and financial constraints while upholding exceptional quality benchmarks. They carefully oversee assets, track advancement, and address possible complications before they intensify, thereby playing a pivotal role in the project's triumphant completion.

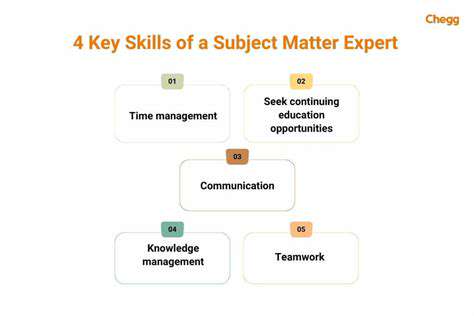

Establishing robust construction management practices requires thorough comprehension of project specifications, encompassing site characteristics, legal requirements, and client aspirations. Skilled managers excel in communication, proficient at nurturing cooperation among diverse participants like designers, technical specialists, subcontracting firms, and property owners. This unified methodology proves indispensable for aligning all contributors toward shared objectives.

Risk Evaluation and Minimization Techniques

Recognizing and addressing potential hazards stands paramount for prosperous construction undertakings. Experienced construction supervisors actively examine possible obstacles, ranging from meteorological disturbances to supply chain interruptions, and formulate tactics to reduce their consequences. This forward-thinking risk control method not only protects the project's fiscal well-being but also guarantees laborer security and punctual project finalization.

Comprehensive risk evaluations employ multiple analytical approaches, including SWOT examinations and situational forecasting. This systematic process helps pinpoint possible dangers and prepares alternative solutions to manage them. Through anticipation and risk reduction, expert construction administrators establish a more regulated and foreseeable project atmosphere, significantly enhancing the likelihood of successful outcomes.

Schedule Coordination and Financial Oversight

Efficient timeline administration and expenditure monitoring represent fundamental components of competent construction supervision. Professional managers employ specialized scheduling applications and other technological resources to measure advancement against predetermined timelines and financial plans. They methodically document outlays, detect budget excesses promptly, and enact remedial measures to preserve fiscal equilibrium.

Quality Assurance and Protective Measures

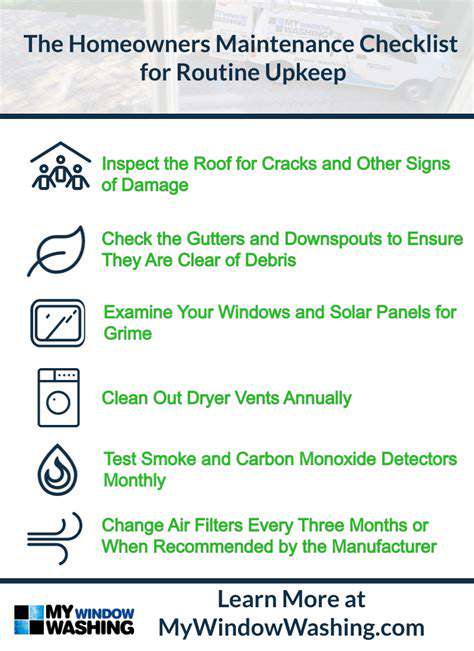

Sustaining superior quality benchmarks and ensuring employee welfare remain critical priorities in construction oversight. Expert supervisors institute rigorous quality verification processes throughout all project phases, from material procurement to concluding evaluations. This dedication to excellence not only guarantees the durability and structural soundness of the edifice but also establishes elevated expectations for the entire undertaking. By emphasizing workforce protection through extensive instructional initiatives and rigorous compliance with safety statutes, experienced managers cultivate a protected and efficient workplace.

Customized Financial Planning & Schedule Administration: An Open Methodology

Comprehending Your Economic Terrain

A personalized financial plan and schedule coordination framework proves indispensable for attaining monetary objectives. It necessitates complete awareness of your present economic standing, incorporating revenue streams, outgoings, holdings, and obligations. This foundational evaluation forms the basis for developing an unambiguous and functional strategy. Scrupulous examination of all monetary inflows and expenditures, from steady wages to intermittent windfalls, proves critical for establishing a practical and attainable financial blueprint.

Evaluating your expenditure patterns remains essential. Documenting each outgoing payment, regardless of magnitude, assists in recognizing segments where reductions are possible or income augmentation opportunities exist. This granular comprehension of your financial circumstances supplies the vital reference points for crafting a bespoke budget and timeline.

Formulating Practical Monetary Objectives

Establishing distinct, quantifiable, attainable, pertinent, and time-constrained (SMART) economic targets proves crucial for maintaining drive and advancement. These ambitions might span from accumulating funds for property acquisition to eliminating credit obligations, or even preparing for retirement. Defining these aims with precise benchmarks and schedules generates a navigational chart for your fiscal voyage.

Ranking these goals according to immediacy and significance also remains vital. For example, settling high-interest liabilities might supersede vacation savings, ensuring optimal utilization of available resources.

Developing an Exhaustive Financial Plan

An elaborate budget serves as an indispensable instrument for economic administration. It delineates your earnings and expenditures, offering a transparent overview of your monetary inflows and outflows. This documentation should incorporate classifications for necessary costs like shelter, utilities, and sustenance, alongside optional spending on recreational pursuits. A comprehensive budget enables progress monitoring toward your financial aspirations.

Assign defined sums to various classifications, accounting for your necessities and preferences. Adaptability proves crucial, permitting modifications in response to unexpected developments or alterations in your economic status. Periodic reassessment and revisions of your budget remain imperative for sustaining its efficacy.

Executing an Unambiguous Timeline

An overt schedule proves essential for maintaining direction. Segment your financial targets into smaller, manageable phases with explicit target dates. This technique facilitates progress tracking and enables essential modifications throughout the process. Representing your timeline visually, perhaps via scheduling software or organizational charts, aids in sustaining concentration and determination.

Employing Technological Solutions for Improved Administration

Utilizing financial management platforms or mobile applications can substantially enhance your budgeting and scheduling efficiency. These digital tools frequently provide functionalities for expenditure monitoring, financial planning, and report generation. They offer perspectives on spending tendencies, assisting in recognizing improvement areas and refining your monetary tactics.

Consider automated transaction configurations, payment deadline notifications, and objective monitoring capacities when selecting financial management software. These characteristics simplify procedures and contribute to a more streamlined and productive management framework.

Periodic Evaluation and Modification

Consistently assessing your budget and timeline remains crucial for preserving its usefulness. Measure your advancement toward targets, recognize any variances, and implement required alterations to your strategy. This continuous appraisal process enables adaptation to evolving situations and ensures your financial scheme stays applicable and realistic.

Don't hesitate to consult professional financial counsel when appropriate. A monetary consultant can supply customized recommendations and assistance for optimizing your budgeting and scheduling management approach.